pa educational improvement tax credit individuals

Elizabeth Hardison - June 14 2019 721 am. Applicants interested in applying as an Educational Improvement Organization Scholarship Organization or Pre-K Organization can apply at DCED Center for Business Financing Tax Credit Division 4th Floor Commonwealth Keystone Building 400.

Pennsylvania Educational Improvement Tax Credit Eitc Program Phoenixville Community Education Foundation

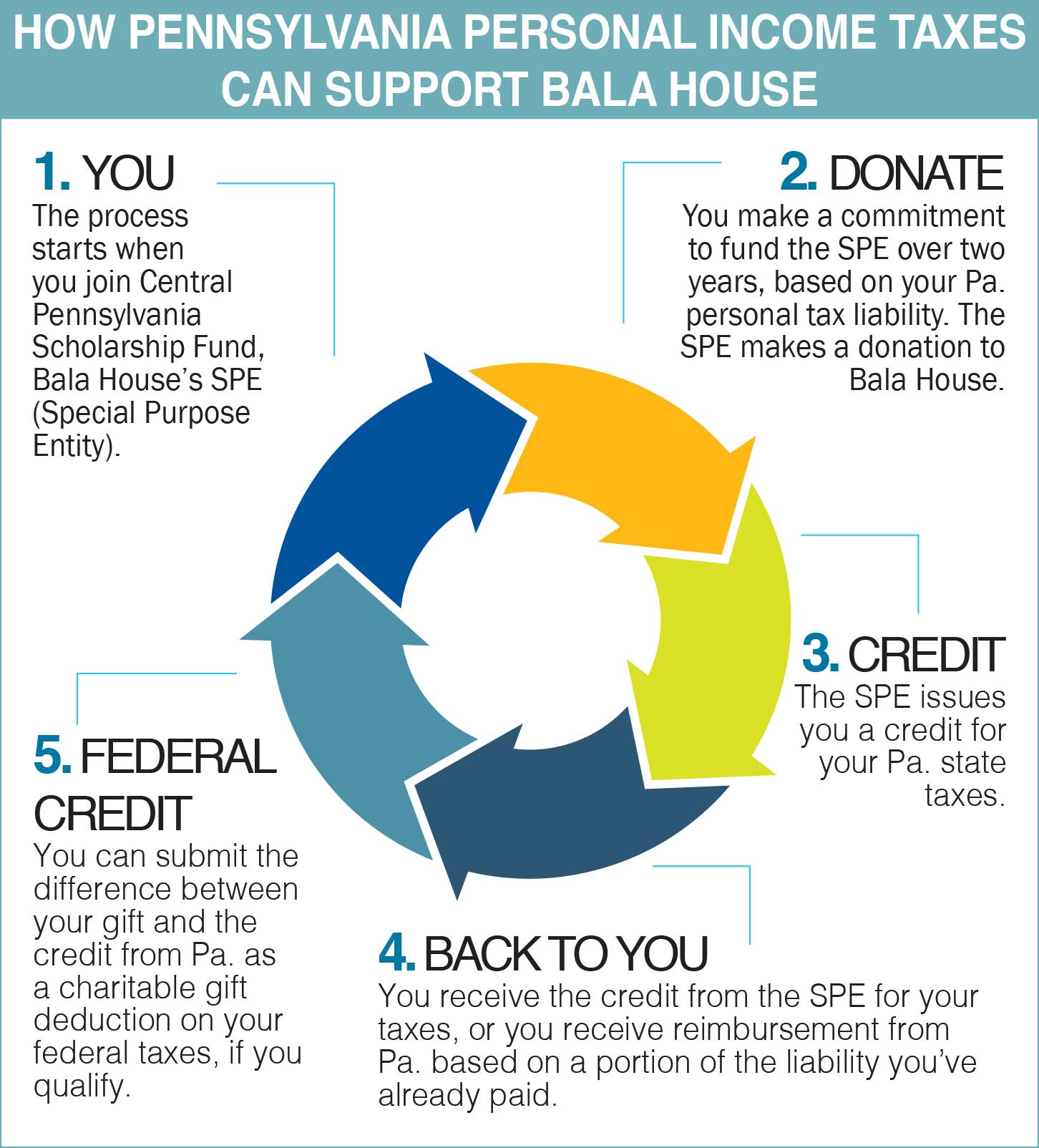

Donate at least 3500 in one check to the SPE.

. How Pennsylvanias educational tax credits are used who benefits and more. Credits are awarded to companies on a first-come first-served basis until the cap is reached. The Educational Improvement Tax Credit Program EITC is a way for you to make a gift to Benchmark School go even further.

This credit will reduce their state tax liability on a dollar-for. A program that benefits. Pennsylvania makes millions of dollars available each year through the Educational Improvement Tax Credit Program EITC to.

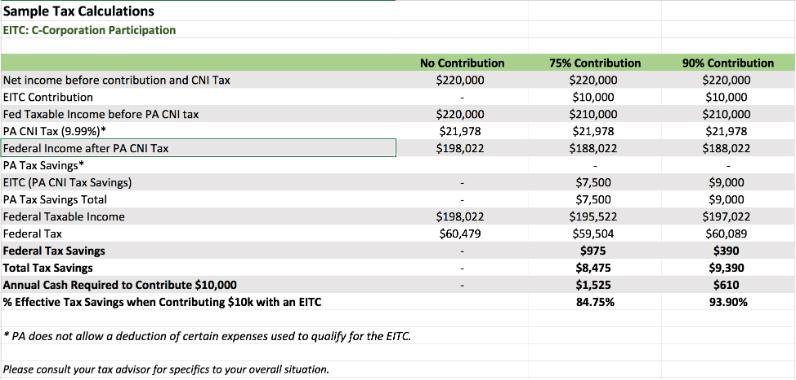

Individuals and businesses who participate in this program receive a state income tax credit equal to 90 of their donation. This translates to a tax credit of 3150 which will be usedrefundable if. Payment to Educational Opportunities a special purpose entity which distributes funds to selected 501 c 3s.

Pa Educational Improvement Tax Credit IndividualsQuestion 1 question 2 185 of federal poverty level Through the educational improvement tax credit program. Pa Educational Improvement Tax Credit IndividualsQuestion 1 question 2 185 of federal poverty level Through the educational improvement tax credit program individuals and businesses direct a portion of their pennsylvania state income tax dollars towards scholarships at state college friends school and other quaker schools across the state. The PA S corporations and partnerships report restricted tax credits on PA-20SPA-65 Schedule OC.

In either case the maximum tax credit is 750000 per company. List of Educational Improvement Organizations Effective 712015 6302016 EITC. However sometimes they are awarded to individual or fiduciary taxpayers.

Pennsylvanias Educational Improvement Tax Credit EITC program is a way for businesses to enrich educational opportunities for students and earn tax credits by donating to an Educational Improvement Organization. 162 funds given to. 40000 Deduction of 40000 under IRC.

PA tax savings 13333 gift x 90 credit 12000. Individual Donor Requirements. Donation to CSFP through CSFP LLC.

Share Safe NetClient CS Portal. The Educational Improvement Tax Credit EITC is available to eligible businesses that contribute to scholarship organizations including pre-kindergarten and educational improvement. Educational Improvement Tax Credit Program EITC Opportunity Scholarship Tax Credit.

Businesses individuals and schools. Through EITC eligible businesses can receive tax credits equal to 75 of their contribution up to 750000 per. Federal tax savings 1333 net charitable deduction x 32 tax rate 427.

The PA Educational Improvement Tax Credits are generous and can reduce the amount of PA tax due for PA taxpayers. Pennsylvania is a unique state that permits you to direct up. The total amount of tax.

Agnes Irwin Magazine Winter 2018 By The Agnes Irwin School Issuu

Tax Credit Gifts Eitc Bala House Montessori Preschool Kindergarten In The Greater Philadelphia Area

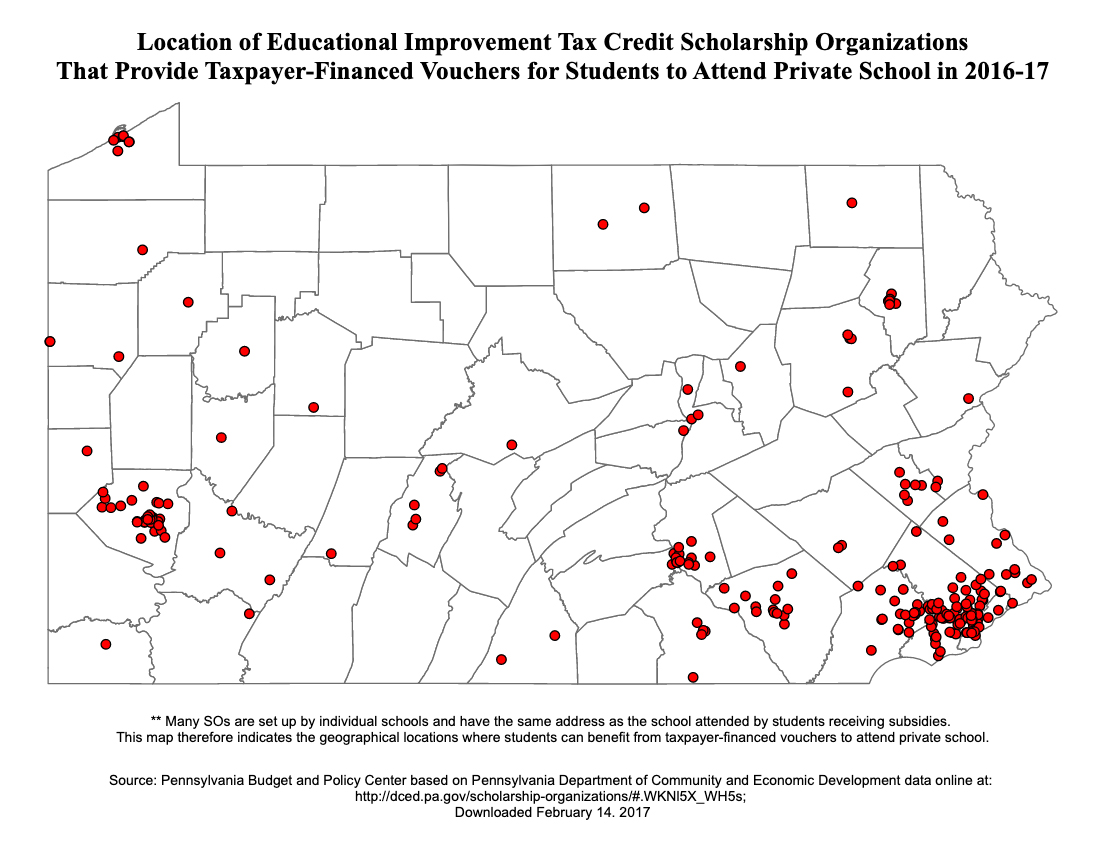

Tax Payer Funded Vouchers Education Voters Pa

Campaign Of Appreciation For Eitc Stretches From Philly To Capitol Jewish Exponent

Pa Tax Credit Eitc Ostc Girard College

Who Gets Pennsylvania S Educational Tax Credits And Who Gets Money Search The Eitc Data Yourself Pennsylvania Capital Star

Educational Improvement Tax Credits Pa Opportunity Scholarship Tax Credits

Special Purpose Enity Holy Trinity Catholic School Altoona Pa

Prc Support Prc Through The Educational Improvement Tax Credit Eitc Program

Educational Improvement Tax Credit Eitc Program Bucks County Community College

Educational Improvement Tax Credit Eitc Holy Cross Regional Catholic School Collegeville Pa

Educational Improvement Tax Credit Program Eitc Penn Mont Academy

Tax Credit Program Overview Blocs

Prc Support Prc Through The Educational Improvement Tax Credit Eitc Program

Eitc Pa Educational Improvement Tax Credit 2020

Educational Improvement Tax Credit Program Eitc Pa Dept Of Community Economic Development

Educational Improvement Tax Credit Program Eitc Pa Dept Of Community Economic Development

Educational Improvement Tax Credit Applications Accepted July 1 Columbia Montour Chamber Of Commerce