does arizona have a solar tax credit

An Arizona state tax credit up to 100000 A 26 federal solar tax credit. Residential Arizona solar tax credit.

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

The credit amount allowed against the taxpayers personal income tax is.

. Below is a summary of the available Federal and State of Arizona solar tax credits for both individuals and businesses. Solar Tax Credit Eligibility You can qualify for the ITC as long as your solar system is new or being used for the first time between January 1 2006 and December 31 2023. Arizona offers state solar tax credits -- 25 of the total system cost up to 1000.

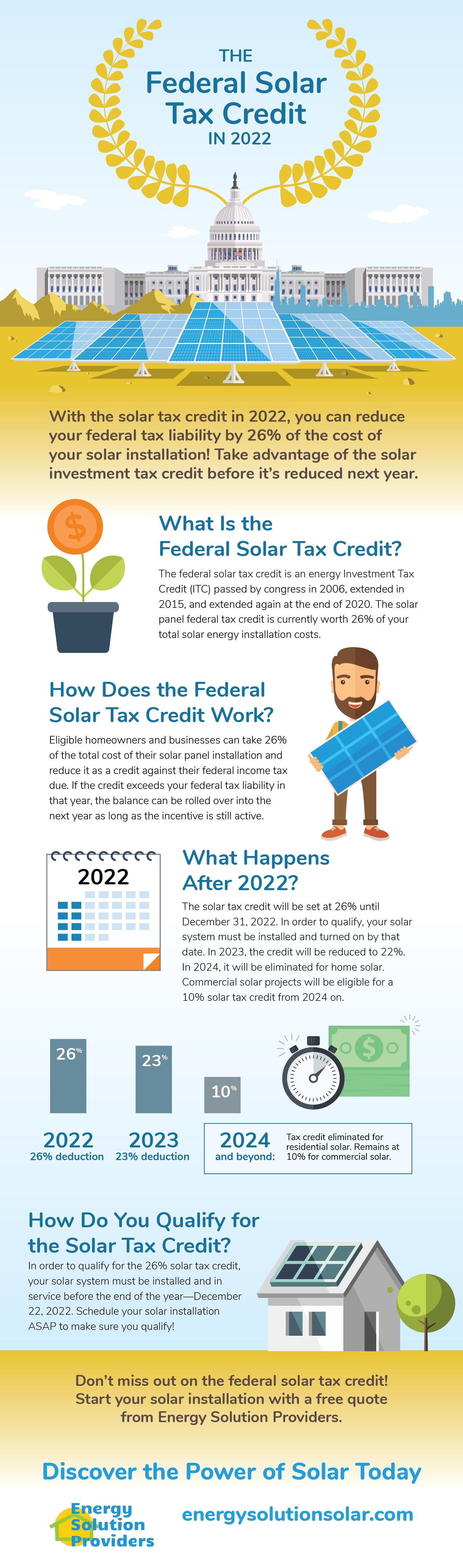

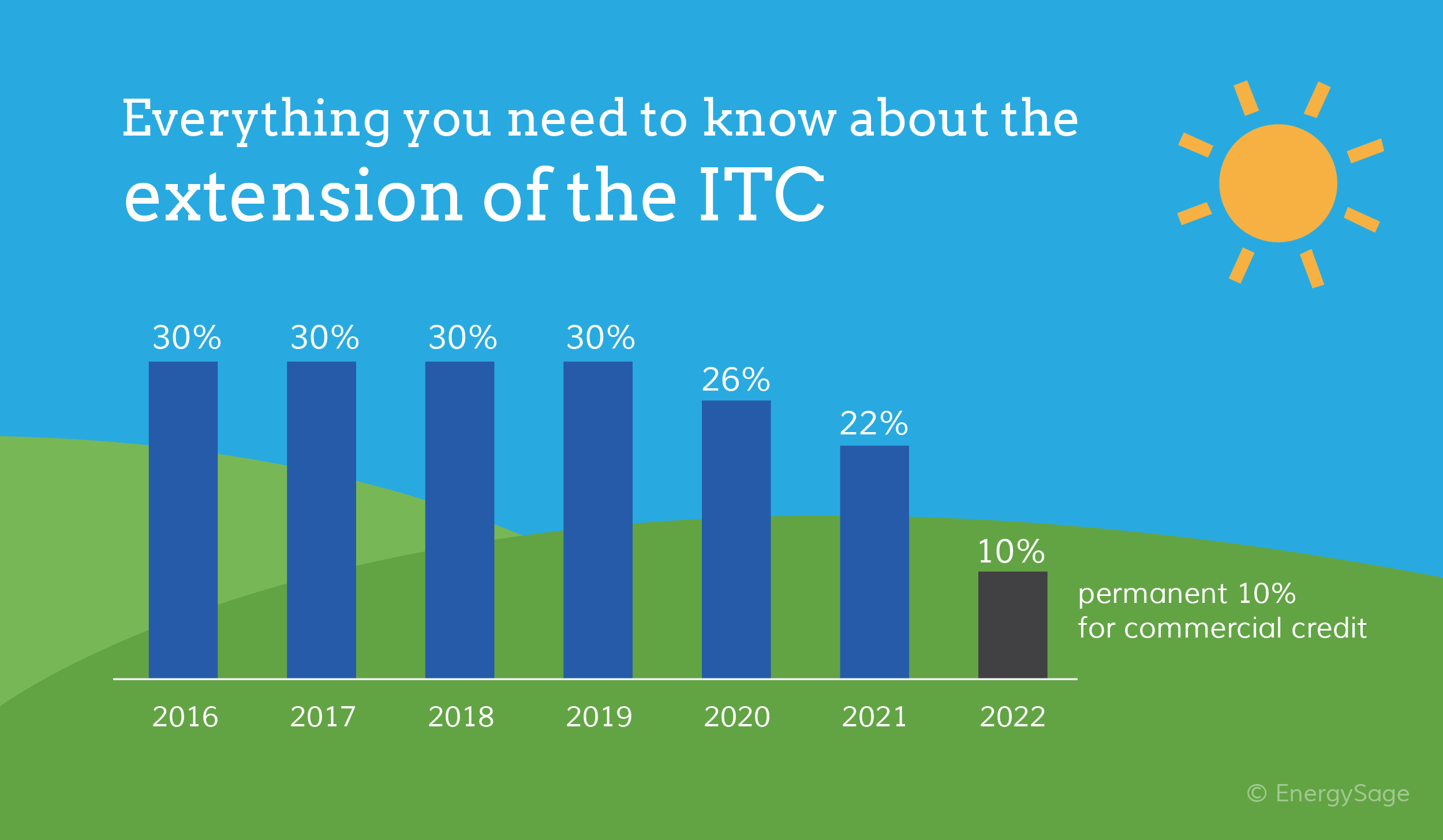

Every resident in Arizona who installs solar panels gets a State Tax Credit of 25 of the total system cost up to 1000 to be used toward State income taxes. The renewable technologies eligible are Photovoltaics Solar Water Heating other Solar Electric Technologies. Yes the solar investment tax credit was extended at the 26 rate for an additional 2 years.

You were age 65 or older in the current tax year or if. One of the most significant solar incentives you can take advantage of in 2021 is the Federal Solar Tax Credit ITC. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable.

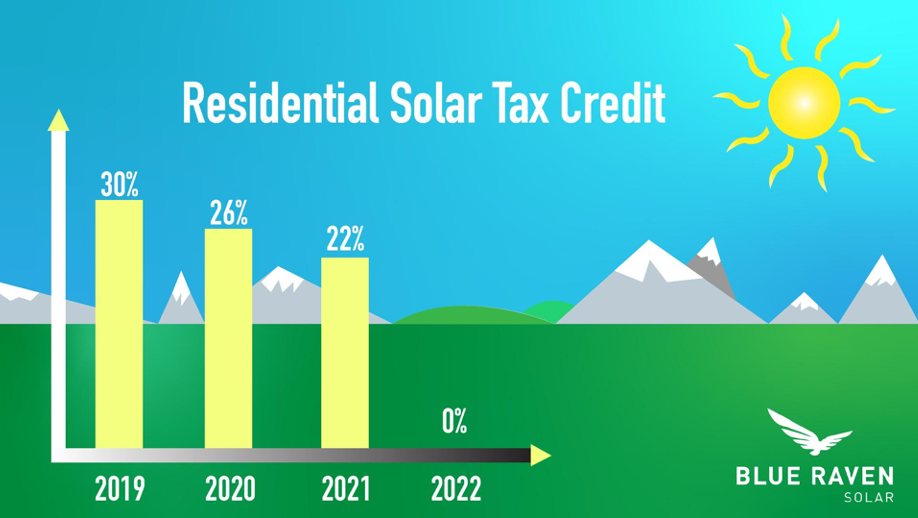

For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would. It was originally going to drop to 22 in 2021 but now with the new legislation being. Arizona state tax credit for solar.

Arizonians who install solar panels on their property have access to. The most significant solar rebate offered in Arizona is the Credit for Solar Energy Devices from the Arizona Department of Revenue. There are several Arizona solar tax credits and exemptions that can help you go solar.

Solar Tax Credits for Individuals Federal Personal Tax. The Residential Arizona Solar Tax Credit reimburses you 25 percent. Arizona Residential Solar and Wind Energy Systems Tax Credit This incentive is an Arizona personal tax credit.

Like the federal ITC in order to qualify. No preapproval is required for an individual income tax credit for a residential Solar Energy Device tax credit that is claimed on Form 310. Obviously this credit isnt nearly as good as the federal tax credit but 1000 is still.

Buy new solar panels in Arizona and get a 25 credit of its total cost against your personal income taxes owed in that year. Other solar tax benefits throughout Arizona. Residential Arizona Solar Tax Credit.

The tax credit amount was 30 percent up to January 1 2020. Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence. The credit is allowed against the.

Yes when you purchase a home solar system in Arizona you can claim 25 of its cost as a state tax credit up to a maximum of. Since 1995 the state of Arizona has offered a 25 tax credit on solar installations with a cap of 1000. Arizona Residential Solar Energy Tax Credit.

The Residential Arizona Solar Tax Credit gives you back 25 of the cost of your solar panel installation up to 1000 off of your income tax return in. At the state level in Arizona not only is there is no sales tax charged but you can receive a state income tax credit of up to 1000 for a solar purchase. Does Arizona have a solar tax credit.

Arizona Department of Revenue. Under this credit system you can receive a tax credit for 26 percent of. Arizona solar tax credit.

23 rows A nonrefundable individual tax credit for an individual who installs a solar energy device in taxpayers residence located in Arizona. Listed below are credits that are available for Arizona. Property Tax Credit -You may claim this credit if you meet ALL of the following.

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Solar Tax Credit In 2021 Southface Solar Electric Az

Arizona Solar Tax Credits And Incentives Guide 2022

The Federal Solar Tax Credit Energy Solution Providers Arizona

Cost Of Solar Panels In Arizona 2022 Tips To Saving Money

Solar Tax Credit Pays For Solar Yuma Solar Pros 48solar

Pricing Incentives Guide To Solar Panels In Arizona Year Forbes Home

Is Solar Worth It In Arizona Solar Panels Savings Az Solar Website

Is Solar Worth It In Arizona Solar Panels Savings Az Solar Website

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Free Solar Panels Arizona What S The Catch How To Get

Are Solar Panels Worth It In Arizona Yes Ae Llc

2022 Arizona Solar Incentives Tax Credits Rebates And More

Arizona Solar Incentives And Rebates 2022 Solar Metric

2022 Solar Panel Costs Average Installation Cost Calculator

Solar Tax Credit Details H R Block

The Extended 26 Solar Tax Credit Critical Factors To Know